Auto Finance Payment Trends

Prime vs. subprime borrowers: Exploring payment preferences

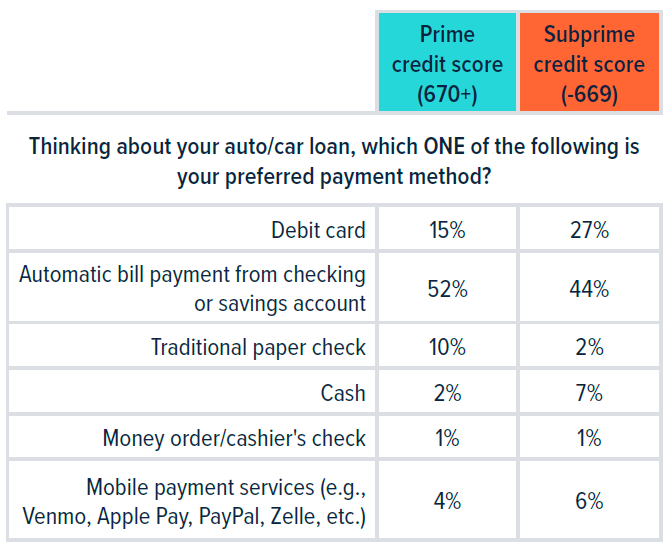

Recent data highlights a significant trend: Younger and subprime customers prefer debit cards and alternative payment methods.

Simplify payments for subprime borrowers

In today’s challenging economy, easy payment methods are essential for subprime customers, who often struggle with financial difficulties and late car payments. User-friendly payment options can help these borrowers manage their payments better, reducing missed payments and defaults.

The Federal Reserve Bank of New York reports that 7.7% of auto loans enter delinquency annually. This trend underscores the need to support subprime borrowers in maintaining loan performance.

2024 ACI Speedpay Pulse Report data highlights a significant trend

Younger and subprime customers prefer debit cards and alternative payment methods for loan payments. Offering these payment options can significantly benefit lenders by catering to these demographics.

Download our latest auto trend report to learn how modern payment options can benefit your business and help your customers manage their finances more effectively.