2025 ACI Speedpay Pulse Report

The need for speed is accelerating

Evolving consumer expectations are redefining digital bill payments and what billers must do to keep up

Ten seconds to stand out in the era of real-time payments

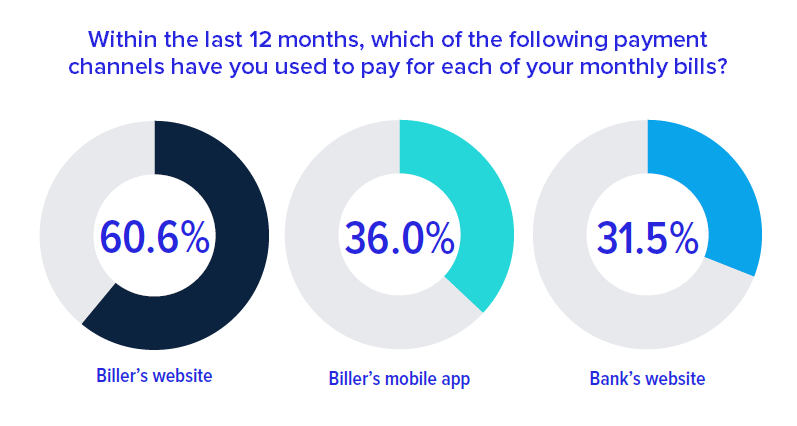

Digital payments are no longer the future—they’re the now. Consumers of all ages are embracing digital-first bill payment experiences, and what were once “alternative” payment methods are mainstream. From mobile wallets to same-day payments, the demand for speed, convenience, and seamless self-service is reshaping expectations across the board.

In this year’s ACI Speedpay Pulse Report, we uncover how:

- Urgency is the new norm: Nearly 3 out of 10 consumers made urgent or same-day bill payments in the past year

- Mobile wallets are mainstream: Almost half of smartphone users now rely on them and not just Gen Z

- AI and automation are on the rise: Consumers want smarter, faster, and more secure self-service options

- Loyalty is digital: Billers can boost engagement with rewards, partnerships, and frictionless experiences

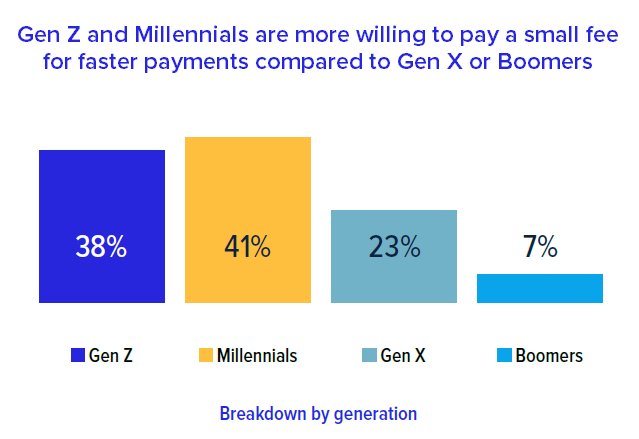

1 in 4

consumers say they would consider paying a small fee if it meant their payment would process faster

3 in 10

consumers reported making urgent or same-day bill payments in the past 12 months

89.2%

of consumers prefer to engage with a live human over an AI-powered solution

It’s time to stand out in the era of real-time payments

Speed is a differentiator

Gen Z and Millennials expect same day payment options, and many are willing to pay for them. A significant proportion of consumers now make urgent or same day bill payments, highlighting the importance of integrating digital bill payment channels with faster, seamless payment experiences that are tailored to their preferences.

AI has promise but it needs a purpose

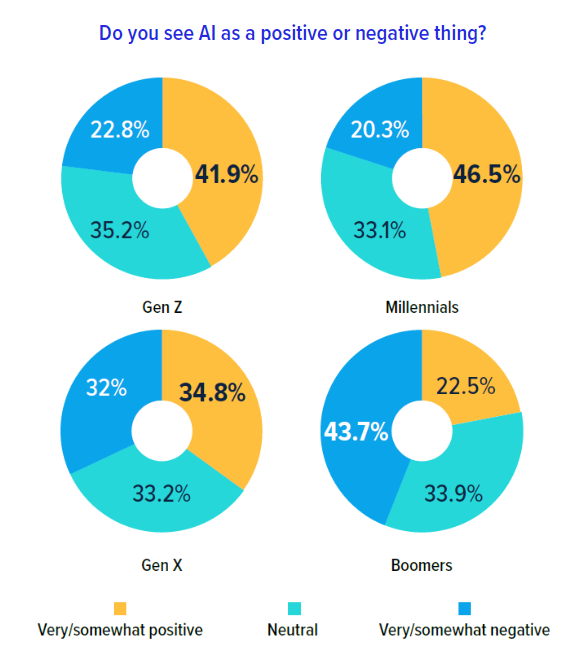

Consumers welcome AI for routine tasks but still prefer human support for billing issues. AI’s potential has captured the imagination of consumers and enterprises, and billers will be keen to explore how it can enhance their business processes and customer experiences. AI is viewed with mixed sentiments across generations, reflecting differing levels of optimism and concern.

Previous ACI Speedpay Pulse Reports

Get strategic with bill payment security

Billers will always be under pressure to increase payment choices and security as digitization and new fraud tactics see ever more ways to enter the market.