Industry Insights

Real-Time Payments: Economic Impact and Financial Inclusion

We unravel the complexities of payments modernization to spotlight the opportunities for the governments and banks charting the path forward for real-time adoption

See what’s inside

- Economic impact analysis of 40 real-time payment markets

- Financial inclusion study for 28 markets leveraging World Bank Findex data

- 3 demographics that benefit the most from financial inclusion

- New revenue opportunities and streams for financial institutions

- And much more…

A win-win for citizens, businesses, and governments

Instant payments drive financial inclusion and change lives by creating a path for financial institutions to serve hundreds of millions of new customers. By allowing for the transfer of money between consumers and businesses within seconds rather than days, real-time payments improve overall market efficiencies in the economy resulting in substantial net savings for consumers and businesses. Those savings, combined with the increased treasury revenue from formalizing previous cash transactions, are boosting GDP growth for countries that have embraced real-time payments modernization.

- $164.0 billion: GDP boost due to real-time payments in 2023

- $116.9 billion: global consumer and business savings in 2023

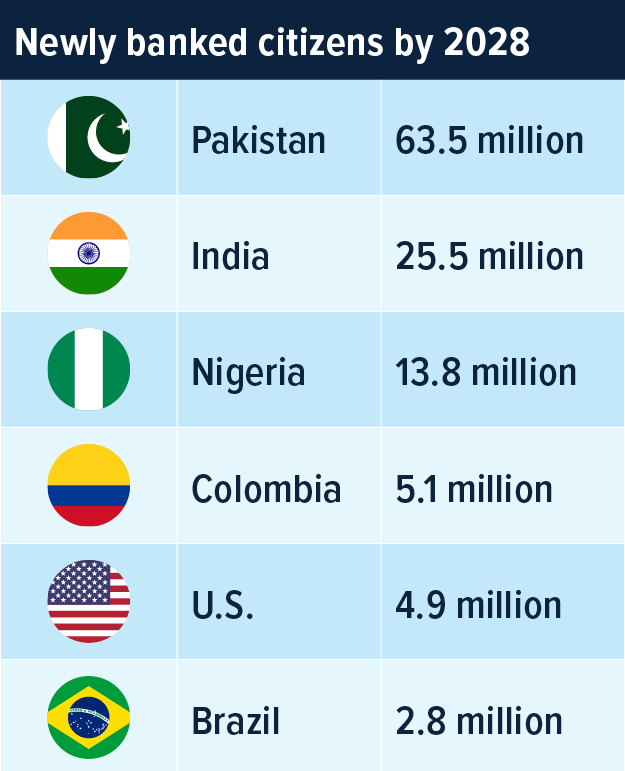

- 167.2 million: number of newly banked citizens by 2028

Regional Spotlights

Formal GDP facilitated by real-time payments in 2023

Nigeria

$7.0 billion

The equivalent to 1.4% of combined GDP or the output of 1 million workers

U.K.

$3.4 billion

The equivalent to 0.11% of combined GDP, or the output of 36,200 workers

U.S.

$2.7 billion

The equivalent to 0.01% of combined GDP, or the output of 17,900 workers

Brazil

$24.6 billion

The equivalent to 1.32% of combined GDP, or the output of 1.3 million workers

India

$50 billion

The equivalent to 1.4% of combined GDP, or the output of 6.8 million workers

Navigating the new reality of payments

We’ve been redefining the payments landscape for nearly 50 years, staying ahead of payment trends and bringing visionary leadership to payments orchestration so you can excel in the market.

ACI Enterprise Payments Platform

Rapidly respond to shifting trends, regulatory mandates, and new competition across all lines of business and payment types with an enterprise payments platform that can be deployed on-premise or in the cloud

High Value Real-Time Payments

Enable least-cost, SLA-driven routing, multi-bank, multi-currency, 24×7 payment processing capabilities and seamless integration with multiple clearing and settlement mechanisms

Low Value Real-Time Payments

Enable banks and processors to connect to all real-time global schemes and deliver value-added services to their customers with a complete, end-to-end solution for real-time and digital payments

Expand your payment capabilities

Stay in the loop

Subscribe to stay up to date with the latest payment trends and product updates.

Chat with the experts

Contact us today to put our expertise and award-winning solutions to work for you.