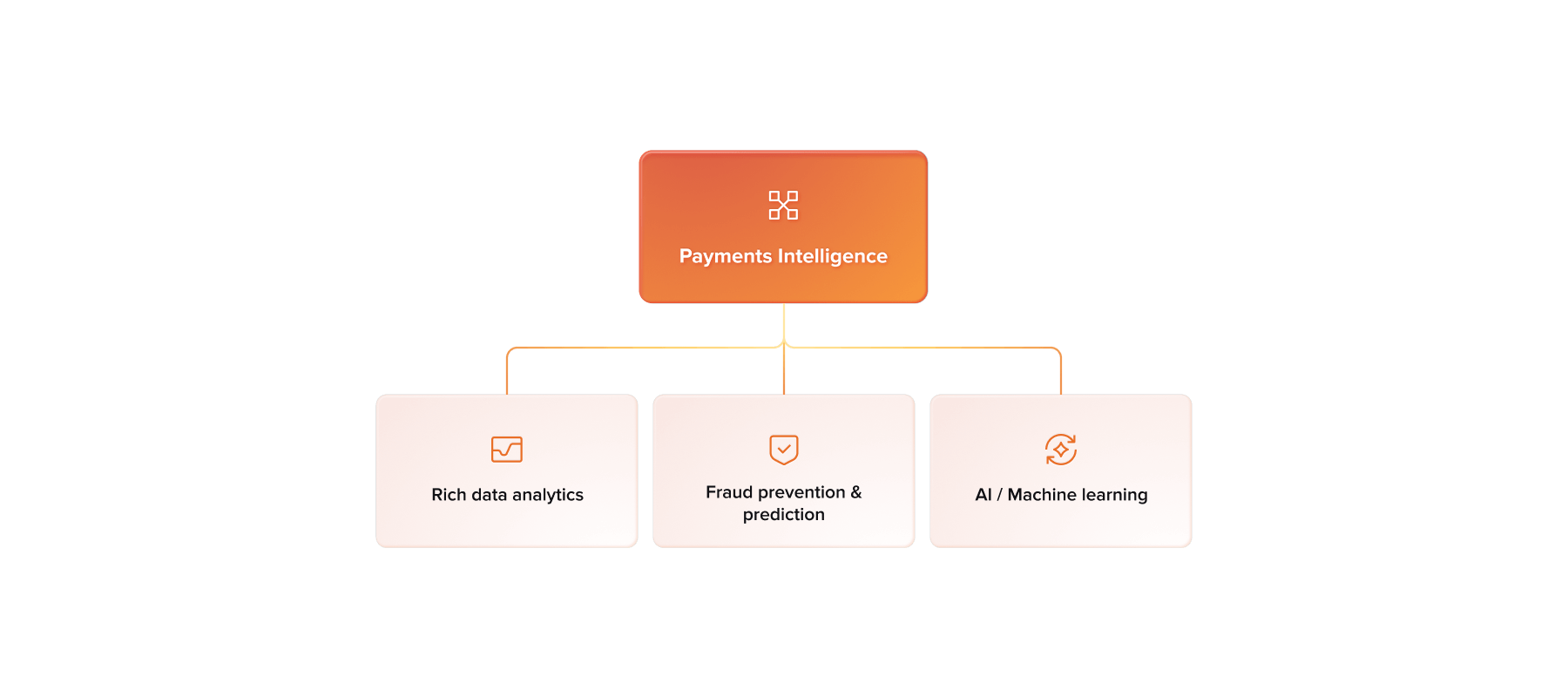

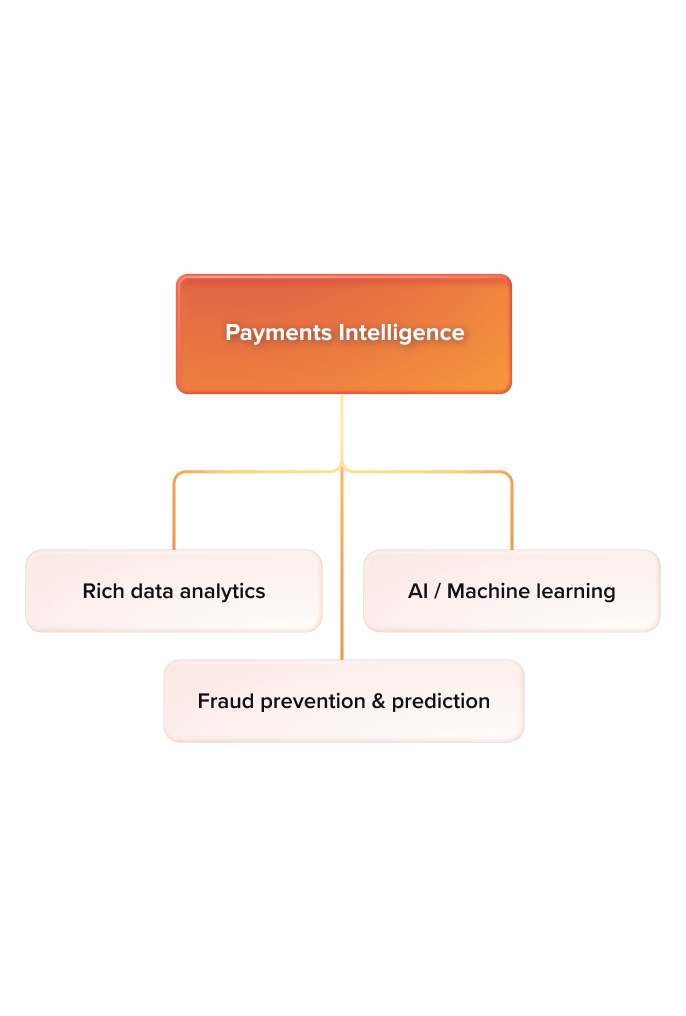

Payments Intelligence

Built to outpace, outsmart, and outperform fraud

Predict and prevent fraud with AI-powered journeys built on one of the largest intelligence networks.

Trusted by thousands of banks, intermediaries, and merchants

Future-proof your fraud strategy

Payments intelligence provides dynamic protection for banking, merchant, and bill payments.

-

Secure, compliant, and trustworthy transactions

Stop fraud and money laundering and stay compliant while your customers make safe, seamless transactions.

-

Data-rich decision-making

Advanced machine-learning and expansive data support fast, informed, and accurate decisions.

-

Smarter detection

Context-aware checks can instantly identify sophisticated attacks at the point of transaction.

AI Capabilities

AI-powered for accurate, scalable defense

Adaptive intelligence, derived from real-world data, empowers you to stay ahead of evolving threats.

Payments intelligence for the entire payments ecosystem

Power and protect any payment, anywhere, at any time for banking, merchant, and bill payments.

-

Banking

Leverage AI-powered technology to react to market changes and automatically adopt new payment types, rules, and regulations.

-

Merchant payments

Get ahead of fraud and protect every payment, every channel, and every customer interaction.

-

Bill payments

Future-proof your payments strategy with a fraud solution that’s easy to implement for a seamless customer experience.

Built for Banking

Quickly adapt for what’s next

Leverage AI-powered technology to react to market changes and automatically adopt new payment types, rules, and regulations.

Compatible with ACI Connetic

-

Cut fraud management costs while improving predictability on premises, in the cloud, or within a hybrid environment.

-

Analyze intelligence across a vast footprint to pinpoint anomalies and keep business running as usual.

-

ACI’s technology ensures robust transaction monitoring and timely reporting of suspicious activities (SARs).

Built for Merchant Payments

Build trust with the power to predict

Get ahead of fraud and protect every payment, every channel, and every customer interaction.

Compatible with ACI Payments Orchestration

-

AI-powered fraud operations increase conversions and reduce costs and losses.

-

Keep your user experience secure and user-friendly.

-

Get capable and reliable support, backed by data science, to meet peak periods.

Built for Bill Payments

Keep payments safe and simple

Future-proof your payments strategy with a fraud solution that’s easy to implement for a seamless customer experience.

Compatible with ACI Speedpay

-

Configure new strategies with easy API and SDK integration.

-

Make payment experiences effortless and increase collections, automatically.

-

Leverage behavioral analytics and user data to reduce fraud losses.

See how intelligent payments orchestration supports fraud management

Here are some real-life stories from the world’s best banks, merchants, and others who protect their payments with ACI.

-

How KTC leveraged AI for precise fraud management

Cash-out scam initial detection rate increase from 33% to

50%

-

John Lewis partnership delivers frictionless, secure checkout experiences

ACI delivered a stable, scalable platform that seamlessly supported an online transaction increase of

35%

-

Westpac New Zealand gets proactive in the fight against fraud

Seamless fraud defense at the scale of

1.6 million transactions per day

-

Aegean airlines flies ahead of online fraud

Proven fraud defense, stopping threats with

97% accuracy

-

Moneris reduces operating costs and improves service

Average loss per merchant incident file has gone down by

25%

-

Mango increases acceptance, reduces risk and expands eCommerce reach

ACI fraud management solution boosted acceptance rates to

97%

Let’s get to work

Dig into the details

Learn how our solutions and expertise can help you take payments intelligence to the next level.

-

Payments intelligence refers to the use of advanced data analytics and machine learning to identify patterns and trends in payment transactions. In fraud management, it helps businesses detect suspicious activity in real time and reduce false positives. By leveraging payments intelligence, organizations can make smarter decisions and improve transaction security.

-

Payments intelligence is essential because it provides deep insights into transaction behavior, enabling proactive fraud detection. Traditional rule-based systems often miss complex fraud schemes, but payments intelligence uses predictive analytics to identify anomalies before they cause losses. This approach helps businesses stay ahead of evolving fraud tactics.

-

ACI’s fraud management solution integrates payments intelligence to analyze transaction data across multiple channels and geographies. It applies machine learning models to detect unusual patterns and optimize fraud prevention strategies. This ensures higher accuracy in identifying fraud while maintaining a seamless customer experience.

-

Yes, payments intelligence can significantly improve approval rates by reducing unnecessary declines caused by outdated fraud rules. By analyzing real-time data and customer behavior, businesses can distinguish legitimate transactions from fraudulent ones more accurately. This leads to better customer satisfaction and increased revenue.

-

Payments intelligence provides insights into transaction trends, risk scoring, and behavioral patterns that help businesses refine their fraud strategies. It can identify emerging fraud schemes, seasonal risk fluctuations, and geographic vulnerabilities. These insights enable organizations to make data-driven decisions and strengthen overall payments security.