Payments in the cloud. It’s a conversation at the top of the agenda for a growing number of financial institutions. That’s because the cloud — public or private — offers these institutions the ability to run modern and agile payments technology to help grow their business and stay current with the changing needs of consumers.

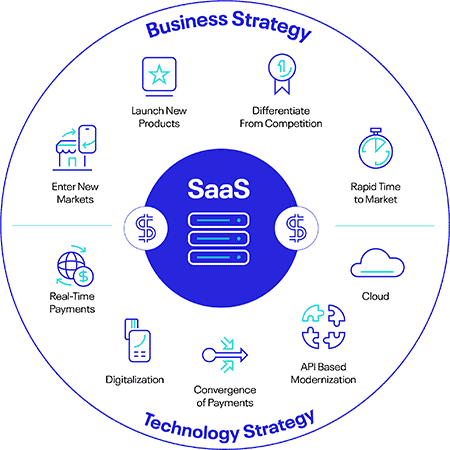

The move from an in-house processing environment to an outsourced solution, hosted and maintained in a public cloud data center (otherwise known as a Software-as-a-Service model – SaaS) is an important consideration in the journey to payments transformation.

There are compelling reasons for banks charting their journey to a managed service offering in the cloud. Most notably they revolve around flexibility, scalability and efficiency.

In short, a SaaS setup is:

Agile

SaaS enables the delivery of new services efficiently and in a scalable/repeatable manner; increasing speed to market and also making tailored services more cost-effective. This also allows for growth in transaction volumes due to new payment types and channels (buy now, pay later or BNPL, cryptocurrencies, mCommerce) or through new real-time overlays such as OSKO or PayTo (to cite just two relevant Australian examples).

Flexible

SaaS providers, such as ACI, provide deployment flexibility with options for customers to run software on their premise, in the public cloud, in a private cloud (bank or vendor), or in a hybrid model. APIs and digital overlay services also enable customers to innovate on top of their solutions.

Cost-effective

SaaS provides a financially friendly alternative to running an in-house, On-Premise IT infrastructure, helping to lower the total cost of ownership.

Another overarching benefit in leveraging SaaS is its ability to help financial institutions address their most pressing concerns and challenges:

- New features/updates ‒ Financial institutions need to adapt to digital acceleration and enable new payment types, in addition to increasing transaction volume/capacity to accommodate the rapidly growing account-to-account, real-time payments market.

- Infrastructure ‒ In addition to meeting new demands, financial institutions must manage and maintain existing legacy infrastructure and solutions for traditional payment methods, which will endure for years to come. In addition, they must also manage the move away from ownership of data center technology.

- Deployment platform ‒ Reviewing their deployment model from on-premise, private cloud and now public cloud technology for quicker implementation is a must.

- Mandates/regulatory compliance ‒ New regulatory mandates like ISO 20022 migration, financial inclusion and PSD2 are approaching to ensure FIs are adapting their systems.

But for many, issues ranging from legacy infrastructure challenges to lack of IT resources or expertise, as well as conflicting priorities, have delayed the pace of change.

Financial institutions must partner with proven SaaS providers to help drive the journey to a modern and agile processing environment. Our own recent experience with Kiwibank highlighted the benefit of not only leveraging a SaaS solution, but also working with an experienced partner to implement and deploy a fully managed payments hub.

Combining the cloud and managed services can deliver a blend of tremendous benefits including scale, cost efficiencies and agility. In a real-time payments world, infrastructure and services are in a near-constant state of change. Employing a managed service in the cloud is the fastest way to ensure organizations can stay ahead of emerging trends and accelerate innovation to meet consumer demands.

See how the largest New Zealand-owned bank accelerated its ability to deliver real-time experiences for its retail and small business customers through a modernized payments hub, deployed in the Microsoft Azure public cloud as a fully managed service by ACI.