Good news for U.S. merchants of all kinds – money will be easier to spend than ever before through different means to digitize payments. Over the last 50 years, consumer spending habits have surged through the use of credit and debit cards and, more recently, the introduction of real-time payments and other alternative payment forms such as PayPal, Zelle and Venmo.

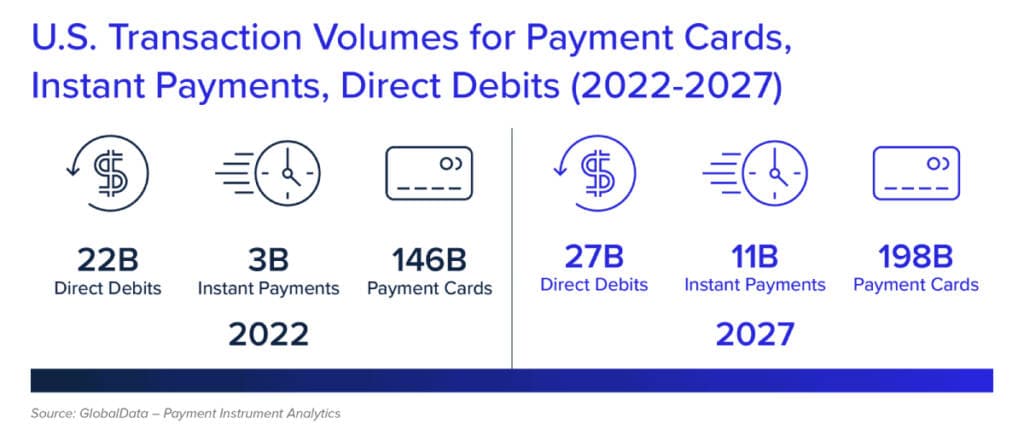

U.S. market projections indicate that consumers will continue to adopt and expand usage of all non-check and non-cash payment types over the next five years. Card transaction volumes are expected to grow by 35%, and instant payments are expected to grow by 316%.

The rise of new payment types has helped merchants in two primary ways:

- The ability to sell more goods and services to a wider group of consumers, both in physical locations and virtually

- Increasing average transaction sizes. Consumers who pay with debit cards typically spend twice as much per transaction as those using cash, and consumers who use credit cards spend on average four to five times more than cash per transaction

The rise in the varying payment types has not only changed the way consumers spend money but it has also opened the door for new shopping channels. eCommerce and mobile shopping have all been enabled through the use of digital payments. As more and more new ways to spend money digitally become available, merchants should look to adopt these newer payment types to meet consumer expectations and choices.