The use of QR codes for payments has made a giant leap forward over the past couple of years. Some of the different flavors of QR code payments will be explored in this blog, along with examples of the creative ways merchants have been utilizing them to drive new experiences and interactions.

Static QR Codes

The first and most common variety of QR code payments is a static version, meaning the code and destination never changes. It typically has the merchant’s payment details and links to a set location where the user has to enter their payment details and the amount to pay. You would likely see this version at a local café, where they have the QR code set in a small stand in front of the register.

QR Code Scammers

Static QR codes are easy for fraudsters to duplicate and replace. In fact, there are many cases around the world where fraudsters either install malware or direct unsuspecting consumers to their own sites to enter payment information. Merchants who still use static QR codes should consider this ABC News article where the FBI warns criminals are using fake QR codes to scam users, and continuously monitor the codes used by their business, or better yet, stop using static QR codes completely.

Static QR Code Examples

At the fuel pump: This version authorizes a unique pump but is still a static type of code. This is great usage; however, it can be compromised. Just like all static codes, it could be compromised by routing the consumer through to a scammer’s site, which downloads malicious software in the background or captures the payment details and forwards them to the merchant’s site for authorization. Merchant and consumer alike are unaware of what happened because the consumer was able to authorize at the pump, and the merchant got paid. But just like regular skimming devices, the fraudsters obtain new card numbers and more, depending on the code they installed on the consumer’s mobile phone. If these sort of QR codes are used, they need to be constantly monitored; perhaps at the same time employees check for skimmers. They can simply look at the URL preview with their phone to ensure they are still directing to the correct place.

At the restaurant table: Food service merchants could place a unique QR code at every dining table to allow diners to pay the check at the table. The amount is input by the server or kept up to date by the POS. Just like at the pump, the links should be monitored to ensure that they have not been replaced by fraudsters.

Dynamic QR Codes

The second and more secure QR code is dynamic – and has encoded in it all the details about the transaction, invoice, bill or restaurant check. This version drives customers to the merchant’s payments gateway, where card details are entered and the bill paid. The system then notifies the establishment’s POS system that the bill for that table was settled.

At the check-out counter: In any type of merchant establishment, dynamic QR codes could be implemented on the physical bill or the POS screen for the consumer to scan. This gives the merchant another contactless alternative payment method.

At the restaurant: The server can drop the check at the table and the diner scans the unique QR code connected to that bill. This version has to include tipping functionality and should allow for easy check splitting. The efficiency created frees up the waitstaff to service more tables and increase customer satisfaction. This short video illustrates how it works:

At the drive-thru: This is another great use for quick-service restaurants (QSRs). QR codes can be dynamically shown on the order summary screen at the drive-thru. This allows customers to skip the payment window, reducing the time required to accept payments and allowing restaurants to better utilize their staff. Watch it in action here:

BOPIS

Another major use for dynamic QR codes is a for buy online pick-up in store (BOPIS). The online order generates a unique code, which is emailed to the buyers – this can then be shown to the employee at counter for pick-up to confirm the buyer and ensure the correct order is pulled.

Endless Aisle

A merchant’s mobile app can dynamically generate a QR code from purchases made in-store through their app so consumers can skip the line. This benefits both the consumer and merchant, as throughput increases. For QSRs, employees can spend more time creating and delivering orders.

Grab and Go!

This is for self-service stores where the shopper has an account and is registering themselves upon entry using a QR code generated by the merchant’s mobile app. Upon entering the self-service store, the shopper opens the merchant’s mobile app and scans their unique QR code that registers the shopper and account that will be charged. When they exit the store, the account is automatically charged and a notification sent to the consumer’s phone so they can verify items they placed back were not charged. The reported accuracy is actually much better than many would think. The most widely recognized version of this use is Amazon Go, but ACI and Auchan have also implemented this in France.

Consumer Generated QR Codes

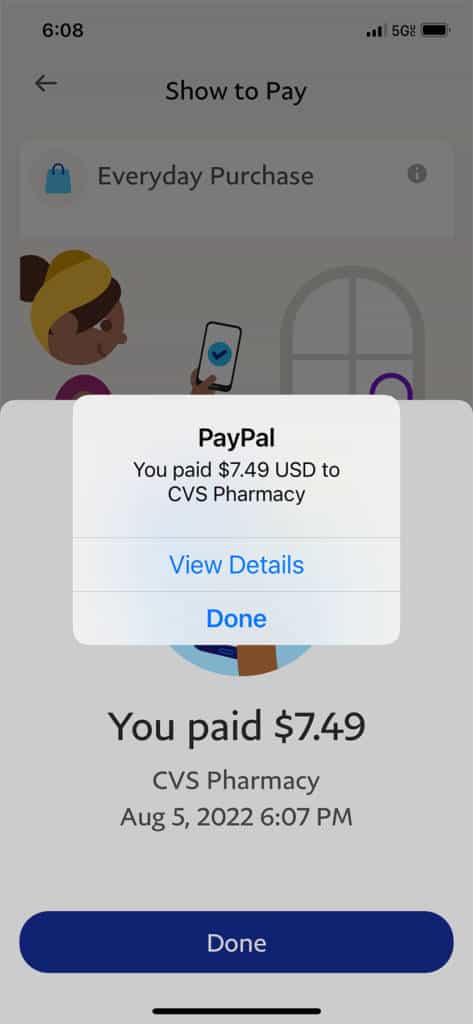

In this instance, the consumer generates a QR Code for the merchant to scan and request funds, after reviewing and approving the amount requested by the merchant. PayPal is one of the pioneers in this area with their “show to pay” option. Merchants such as 7-Eleven, CVS, Walmart and a few others already accept consumer-generated PayPal QR codes. More merchants are expected to follow if usage increases.

Wanting to give it a try, I went down to my local CVS. It took a few seconds longer for me to bring it up on my phone compared to pulling out a credit card or tapping with Apple Pay, but the cashier scanned it and a few seconds later I received a confirmation both in the app and as a pop-up on my phone It worked flawlessly, and the entire transaction time was about average.

Continuing the conversation

QR codes can also be used after the payment to continue the interaction with the consumer. A final receipt can have a dynamic QR Code on it that can help continue engagement with the buyer. The unique code could lead to a survey or ask them to recommend your store on social media in exchange for a reward. It could also link to loyalty program options or to download a merchant mobile app, which presents further communication opportunities. Finally, it could push a coupon for a discount on a future order.

There are many more ways that QR codes can generate unique interactions for merchants. Learn more about ACI Omni-Commerce QR code capabilities and see more examples.