Much attention is paid to the cost of higher education – how it’s rising; how colleges and universities are tasked with doing more with less; how families are struggling to make the dream of a college education come true for the next generation; how graduates are grasping at ways to pay off student loan debt. Future campus payment systems will alleviate some of the pain by rising to these challenges.

Create Happy, Safe and Affordable Education

College and university Chief Financial Officers should focus on new ways they can improve the arduous experience of paying for education. This pivot will create happier families, safeguard sensitive banking information and eliminate the majority of tuition payment processing costs for the institutions. This requires university personnel to embrace the rapid disruption of how payments are made and ideate around ways to improve campus payment systems.

Interestingly, improving the payments value chain for higher learning institutions was the focus of a recent survey commissioned by ACI Worldwide and research firm Ovum. The results provided a snapshot into the perceptions held by leaders at these institutions and how they compared to leaders in banking, insurance and government.

Most Schools Plan to Disrupt their Payments Value Chain

The survey revealed that colleges and universities are thinking about how to improve payments, both operationally and from a student experience perspective. Notably, 52 percent of higher education institutions want to disrupt their payments value chain by reducing the number of intermediaries.

They plan to remove intermediaries like credit card networks from the payment processing value chain. This position comes from viewing institutions of higher learning as providers of not just education but also an environment that embraces disruptive innovation.

As the customer experience and cost structure of payments shift, colleges and universities are realizing the positive impact that can be made by changing their campus payment systems.

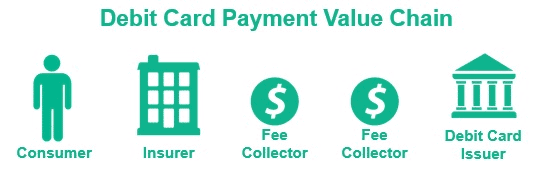

Multiple fee collectors choke today’s payment value chain. They make payments more expensive, slower and less secure.

To reduce the fee collectors, higher education institutions plan to connect directly to debit card issuers as shown below.

Addressing the Rising Cost of College Education

Ultimately, higher education institutions need avenues for insightful efforts that, when taken, would directly reduce the cost of fees and tuition. For example, if a university could decrease the fee collectors in the payments value chain to provide a significantly lower cost method of payment processing, that savings could be used to offset the cost of fees currently being passed on to students. This would reduce the financial burden that lands on students and their families.

Looking to Campus Payment Systems for Possibilities

Chief Financial Officers willing to consider how payments can be optimized will find interesting and new opportunities.

The survey also found that 46 percent of higher education executives are evaluating direct connections with banks to eliminate or reduce reliance on card networks as a means to reduce fee collectors in the payment value chain. With 85 percent of banks reporting wanting to work more closely with higher education institutions to reduce costs, it’s likely that Chief Financial Officers looking to establish direct payment connections will be able to negotiate lower rates.

Disrupting the value chain was cited as the number one priority for improving the payments experience by leaders from sectors beyond higher education, to include banking, insurance and government. Removing the fee collecting intermediaries will speed up money movement to satisfy the demand of today’s students expecting everything to be real-time. Stronger security will also result from fewer parties touching families’ sensitive banking information.

The same survey revealed that respondents are also looking to expanded payment options as a means of providing an improved student, parent and alumni experience; 91 percent of those polled report students and families want more convenient payment options and 50 percent are evaluating at least five new payment methods.

Incorporating New Payment Methods on Campus

New innovations to incorporate in campus payment systems include:

- Implementing Mobile Point of Sale – Turn smartphones and tablets into cash registers that can accept card payments anytime, anywhere, including at alumni events

- Consider Virtual Collection Agents – Improve financial literacy with timely and insightful information and provide personalized online debt repayment negotiation

- Keep an Eye on the Future – Reduce future fees by looking for a campus payment system that will eliminate the middlemen

If all of that effort translates into reduced tuition and fees, Chief Financial Officers would not only add value to their institutions, they’d be transforming the student experience by providing something that for years now has felt like a fairytale – a college education that a family can afford.

Take the next step towards making education more affordable. See your peers’ plans in the full survey results.