- Solutions

- Banking

-

- ACI ConneticUnified cloud payments platform

- AcquiringDigital acceptance, merchant management

- IssuingDigital payments and accounts issuing

- Fraud managementReal-time enterprise fraud management

- RTGS / Wires and cross-borderMulti-bank, multi-currency processing

- Real-time, instant paymentsComplete real-time payments processing

- ATMsSelf-service, omnichannel digital experience

- Central infrastructureInnovative real-time payment infrastructure

- NEW Payment Hubs: Why Banks Must Move Forward With Urgency

-

- Merchant payments

- ACI Payments Orchestration PlatformEnable customer journeys across commerce channels, accept payments, prevent fraud and optimize your payments journey

- In-storeDynamic, modern in-store payments

- eCommerceOnline and mobile payments

- Alternative payment methodsGive more ways to pay

- Value-added servicesEngagement, optimization and reporting

- Fraud managementEnd-to-end fraud orchestration

- Risk, security, and complianceAchieve and maintain compliance

- NEW Datos names ACI Worldwide best-in-class in payments orchestration

- Industries we serve

- Billing and bill payments

- ACI SpeedpayDrive customer satisfaction with the widest range of bill pay options in the industry.

- Bill payment APIs and SDKsOutsource bill payment processing

- Fraud managementAI-based fraud orchestration technology

- Alternative payment methodsGive more ways to pay

- Loan servicingPreferred loan payment options

- Treasury managementStreamline and integrate your back office

- Automated debt collectionImprove your collections process

- Digital walletsManage digital cards and payments

- PCI compliance and securityAchieve and maintain PCI compliance

- Industries We Serve

- Fraud management and payments intelligence

- Fraud managementFraud solutions to minimize risk and prevent fraud

- Fraud management for bankingEnterprise-wide fraud prevention

- Anti-money launderingStay ahead of money-laundering schemes

- Robotic process automationAutomate payment processing operations

- Fraud management in the cloudProtecting your business in the cloud

- Fraud management for merchantsProtect payments from end to end

- ChargebacksPrevent chargebacks before they happen

- SCA complianceAchieve and maintain SCA compliance

- Digital identity solutionsConfirm identities with behavioral analytics

- NEW Scamscope fraud report: APP scam trends from around the globe

CompanyPrime Time for Real-TimeDiscover the Real-Time Landscape in 2024 and Beyond

How are real-time payments redefining the global economy?

CustomersPartners

Home

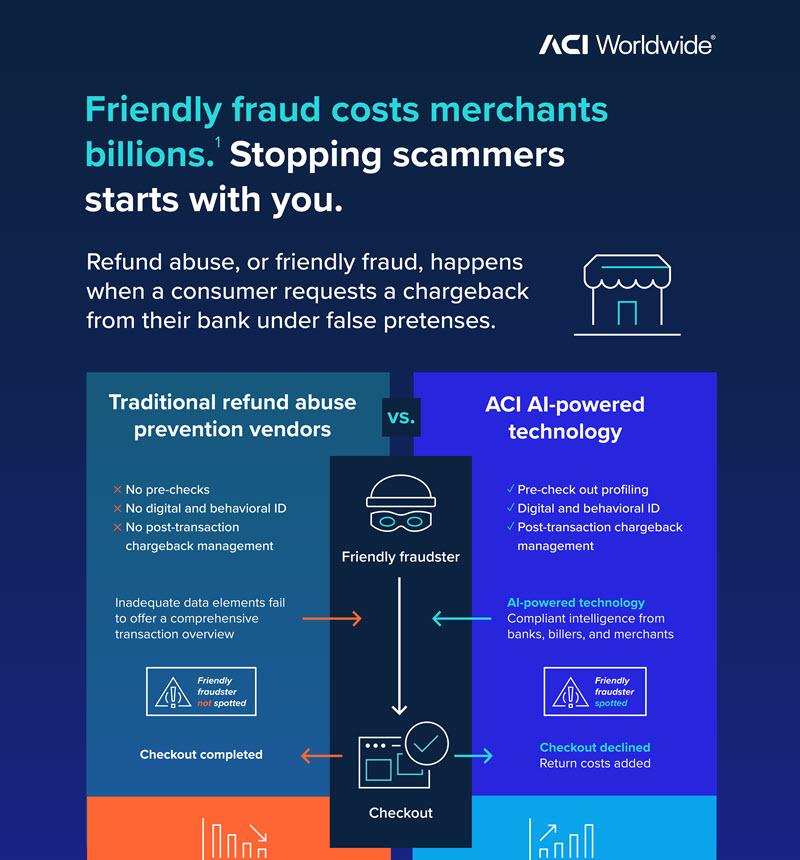

Friendly fraud costs retailers $100B annually1 — use these expert insights to reduce losses this year.

Refund abuse, return abuse, and policy manipulation constitute first-party fraud, where customers intentionally deceive businesses for personal gain. In these scenarios, customers may file chargebacks under false pretenses. This might include returning products that are either damaged, counterfeit, or not even related to the original purchase, such as empty packages. Additionally, customers may exploit gaps or ambiguities in company policies to circumvent established return policies, effectively taking advantage of the system. Such practices undermine the integrity of retail operations and lead to significant financial losses for businesses.

The unfriendly impact

Due to manual interventions and false claims, these types of fraud cost retailers $100 billion annually. While returns are often viewed as typical chargebacks, it is important to highlight those that are linked to false returns and claims.

Top 5 strategies to prevent friendly fraud

Lowering risk while providing popular payment methods and seamless checkouts is essential for maintaining competitiveness in today’s market. Here are our top five tips for addressing this costly fraud trend:

- Self-learning: Harness advanced self-learning algorithms to enhance the precision of forecasting returns and refund abuse. By drawing on comprehensive, actionable intelligence from secure databases, you can pinpoint instances of friendly fraud with remarkable accuracy, effectively reducing risk, while meeting the increasing demands for consumer security.

- Digital identities and profiling: Enhance your decision-making processes by leveraging comprehensive identity insights that facilitate advanced profiling and the real-time detection of fraudulent transactions. Foster trust in legitimate transactions by utilizing thousands of data points, including behavioral patterns, transaction history, and device information. This nuanced understanding enhances your security measures and streamlines your operational efficiency by minimizing false positives. By integrating these insights into your risk assessment frameworks, you can establish a robust security infrastructure that mitigates risks while promoting a seamless user experience.

- Secure data-sharing technologies: Integrate technologies that securely share intelligence to enrich your payment decisioning while understanding new and emerging threats. By leveraging secure data-sharing technologies, businesses can access a wealth of anonymized, real-time data points that provide deep insights into transaction patterns and potential fraud indicators. Merchants can seamlessly integrate these technologies into their existing systems, allowing for a more dynamic and responsive approach to fraud detection and prevention. Additionally, the expansive network amplifies the reach and relevance of shared intelligence, translating into actionable insights that bolster decision-making accuracy. These technologies enhance security protocols and promote stakeholder collaboration for a safer financial landscape.

- Action against return/refund abusers and policy manipulators: Implement a multifaceted approach to combat fraudulent activities by leveraging extensive data analytics, cutting-edge AI technologies, and strategic human foresight. This comprehensive strategy enables merchants to craft informed policies that effectively minimize friction for genuine customers, reduce false positives, and significantly lower fraud-related financial losses.

- Building evidence: Enable advanced technologies that meticulously gather and analyze multiple data points, building compelling cases against false claims, significantly enhancing the ability to dispute chargebacks and recover lost revenue. Additionally, real-time data processing and machine learning capabilities ensure that merchants remain one step ahead of evolving fraud tactics, safeguarding their financial interests and maintaining the integrity of their operations.

How does ACI mitigate return and refund abuse?

By leveraging ACI’s AI-powered technology and digital identity services, merchants can manage fraud risk thresholds, dispute false claims, and protect profit margins with accurate data-driven evidence.

Stay secure

Discover how to blend machine learning, predictive and behavioral analytics, positive profiling, customized fraud strategies, and human expertise to combat friendly fraud in real time.

Get more expert insights into the latest fraud threats and prevention tactics:

1 Return fraud: The $100 billion problem facing retailers