The payments industry is constantly looking at ways to streamline retail payments, reduce costs, increase security and improve the customer experience. But these efforts inevitably introduce more players into the ecosystem, or lower cost and risk on one side (i.e., the merchant) while increasing cost and risk on the other (i.e., the bank).

When it comes to real-time or instant payments, it’s going to take more than simply modernizing existing ACH rails to drive adoption of digital wallets, among other goals. And without mass adoption, the needs outlined above cannot be claimed to have been successfully met. This is where real-time payments need to enable digital channels.

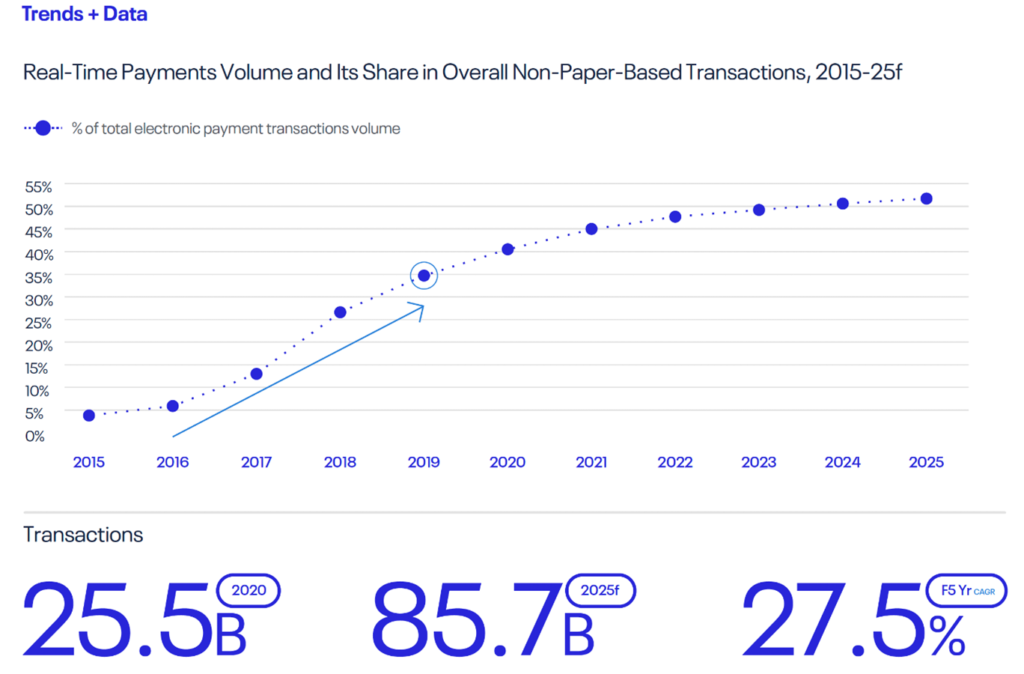

Take the example of India, and its UPI real-time payments scheme. This is a non-card, real-time and digital payment method, which relies on the payer using their mobile phone for authentication, and the payee on having access to digital APIs that are provided by the scheme through the retail and acquiring banks. In India, UPI went live with the payment rails and digital overlay services at the same time. Adoption, as seen in the graphic below, has been rapid, reaching significant scale.

The payments industry globally is hyper-aware of the sustained high growth of real-time and digital payments in India, and the country’s hugely successful approach is influencing the ongoing development of real-time schemes around the world. Here are some of the ways this is playing out in different regions:

- The U.K. is following a Request to Pay (R2P) approach, which drives real-time payments usage through digital form factors. R2P is a digital request that the payer receives on their mobile device, usually on a banking application or third-party fintech application. The payer then either approves or rejects the request, and if approved, automatically initiates a real-time credit transfer to the payee. Although real-time payments have been available in the U.K. since 2008, growth is anticipated to accelerate in the coming years through 2023, before leveling off again through 2025, attaining a five-year CAGR of 11.6 percent. These payment schemes sit separate to the real-time payment schemes by enabling a digital customer experience “overlay.” In the U.K. example, the underlying payments rail for R2P could also be a card, whereas European systems are being developed for real-time payments only.

- In Europe, a new scheme to compete with the existing card schemes is being investigated, led by 31 European banks/credit institutions and two third-party acquirers. This “European Payments Initiative” (EPI) will sit on top of the real-time payment schemes that are live across Europe, leveraging digital methods and PSD2 APIs to ensure adoption.

- The U.S. has Request for Payment (R2P) on the The Clearing House (TCH) RTP rails, and Zelle is already a person-to-person overlay moving to TCH’s RTP rail. Zelle is also looking at how to enable an R2P bill pay experience to rival Mastercard’s launch of BPX, which also rides atop the TCH RTP rails. A third network, FedNow, is currently being piloted by the Federal Reserve and is expected to launch in 2023. FedNow will allow P2P, B2B, B2C, C2B and G2C payments. Its aim is to facilitate real-time payment services for banks of every size in the country, which will enable the establishment of a wider presence than is possible with the other available networks.

- In Brazil, PIX was launched in 2020, with a combined real-time rail and digital overlay capability, with the central government being the first user of this new real-time and digital method. It is estimated that the volume of transactions in Brazil grew by almost 50 percent between May 2019 and April 2020. With the launch of PIX, Brazil moves to the next level in terms of real-time payments.

- Argentina has two real-time payment schemes in place; Pago Electrónico Inmediato (PEI), launched in 2016, and DEBIN, launched in September 2017; both are still developing and currently contribute a low share of transaction volumes. However, with growth of 145 percent year over year and strong adoption forecast, real-time payments have a lot of potential in this market.

- The Chinese real-time payments market is currently very strong; real-time payment transactions in 2020 approached 16B. China’s real-time payments scheme is IBPS, launched in 2010 by the People’s Bank of China (PBC). IBPS offers two types of real-time payments (single instance and recurring), and two initiation methods (bank account and/or mobile number). IBPS integrates the online banking operations of most of China’s domestic and foreign banks, enabling customers to make online transactions in real time.

- Meanwhile, across the hugely diverse regions of the Middle East and Africa, multiple RFPs are being launched by central infrastructures looking for an elegant solution, perhaps similar to UPI in India, providing digital overlay capabilities on top of real-time rails.

Globally, the industry is transforming to meet the demands of a modern society that wants instant gratification and expects the slickest of slick digital experiences in all of their dealings. Global real-time payments innovation arguably ramped up five or more years ago, but it is the shift towards real-time and digital experience that will see real-time payment volumes rise dramatically. This means the market will move its focus away from traditional card schemes, into digitally native, real-time and secure modern payment methods, delivered by national infrastructures with global interoperability.

Gain a comprehensive look at the European Payments Initiative, a pan-European payments solution for consumers and merchants.